When you come across housing market news, mentions of Federal Reserve actions might catch your attention. But, what's the actual impact on your plans to buy a home? Get insights into the interplay between the Federal Reserve, inflation, and mortgage rates to make informed decisions.

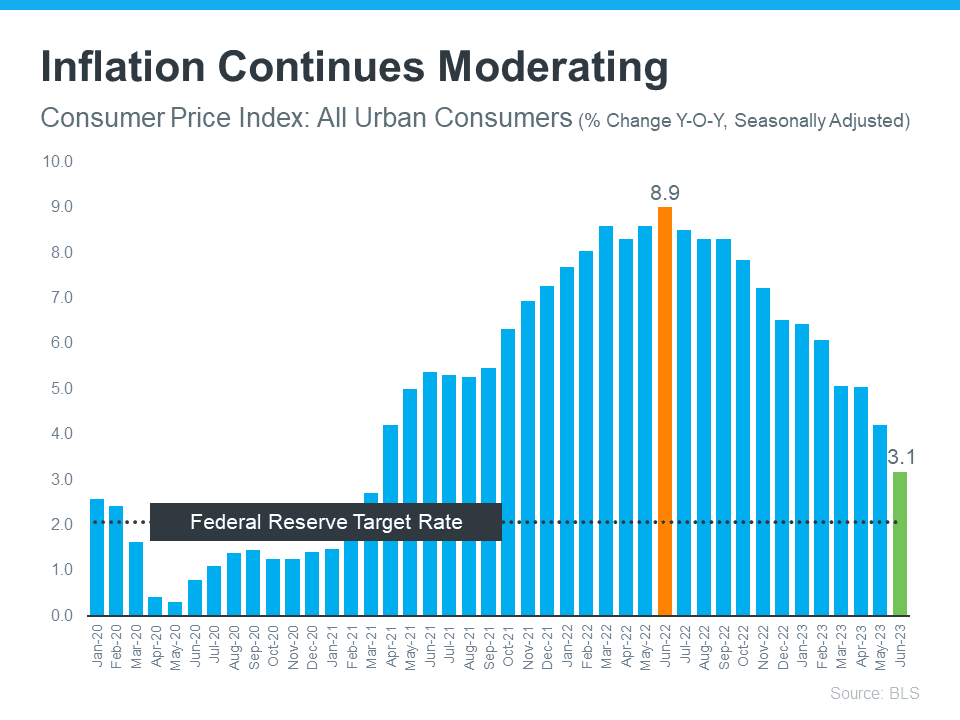

The Federal Reserve, or the Fed, is actively tackling inflation. Despite a cooling trend in inflation over the last 12 months (as depicted in the graph below), recent data shows it still exceeds the Fed's 2% target:

While you might have hoped for the Fed to halt its rate hikes given the progress towards curbing inflation, they remain cautious, aiming to avoid premature actions that could lead to a resurgence in inflation. This approach led the Fed to increase the Federal Funds Rate recently. According to Jerome Powell, the Chairman of the Fed:

"Our commitment is to bring inflation back to our 2 percent target and to maintain well-anchored longer-term inflation expectations."

Greg McBride, Chief Financial Analyst at Bankrate, sheds light on the relationship between high inflation, a robust economy, and the Fed's recent choice:

"Persistently high inflation is a concern. The economy shows remarkable resilience, the labor market remains strong, but these factors might contribute to stubbornly high inflation. Therefore, the Fed needs to exercise more caution."

While a Fed rate hike doesn't dictate mortgage rate shifts directly, it is a major influence. As reported by Fortune:

"The federal funds rate stands as the interest rate charged by banks to each other for interbank lending... When inflation surges, the Fed raises rates to heighten borrowing costs and moderate economic activity. Conversely, in times of low inflation, rates are reduced to boost economic growth."

How Does This Affect You?

In essence, high inflation corresponds to elevated mortgage rates. However, if the Fed successfully curbs inflation, it will likely lead to reduced mortgage rates, enhancing the affordability of home purchases.

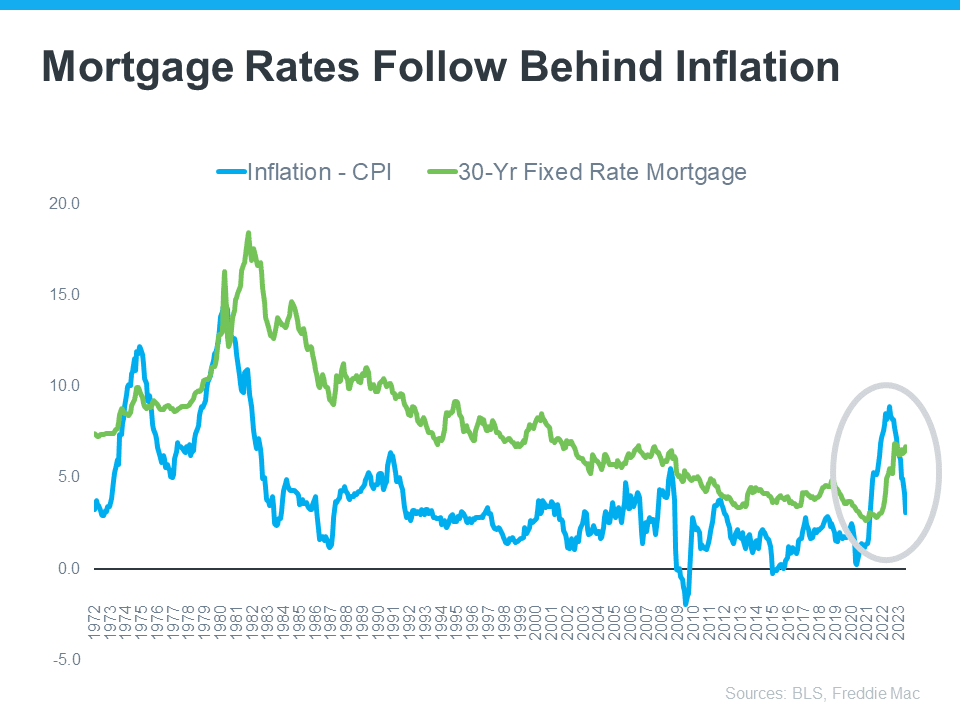

The graph below visually reinforces this notion, demonstrating a correlation between decreasing inflation and lower mortgage rates:

The data illustrates the gradual decline in inflation (represented by the blue trend line), which historically tends to lead to a similar trajectory in mortgage rates (depicted by the green trend line). McBride predicts the trajectory of mortgage rates:

"With the context of diminishing inflationary pressures, we anticipate a more consistent decline in mortgage rates throughout the year, especially if economic and labor market growth slows."

In Conclusion

The fate of mortgage rates is intertwined with inflation. As inflation subsides, mortgage rates are likely to follow suit. Make informed decisions about your home buying journey.

Reach out to gain expert insights into shifts in the housing market and their implications for you.