Consumer Confidence & Financial Markets Continue to Jump in January; Agents Report Strong Start to 2024 Market.

Late January 2024 Update

Hard monthly data for national-market listing and sales activity in January will not become available until late February, but preliminary indicators and anecdotal reports from the field strongly suggest that with the dramatic improvements since October in interest rates, financial markets, and consumer confidence, both buyers and sellers are re-engaging to a much greater degree than in late 2023. (Extreme weather, however, reduced the rebound in some regions, presumably just temporarily.) The extent to which prospective sellers - many of whom held back from selling over the past 18 months - decide to list their homes will be particularly important to the supply and demand dynamics which underpin the market.

December data, while useful for context, was generally not yet significantly affected by the recent changes in economic indicators. While waiting for clarity on January's numbers, this update will review the latest economic and market data available.

A national report is a huge generalization of conditions and trends across thousands of different markets of varying values, conditions and trends. Data from sources deemed reliable, but may contain errors and subject to revision. Last period figures are sometimes labeled preliminary. All numbers should be considered approximate.

"Given the recent stabilization in [mortgage interest) rates, potential homebuyers with affordability concerns have jumped off the fence back into the market. Despite persistent inventory challenges, we anticipate a busier spring homebuying season than 2023, with home prices continuing to increase at a steady pace." FHLMC (Freddie Mac), 1/25/24

"Over the last two months, [consumer] sentiment has climbed a cumulative 29%, the largest two- month increase since 1991...For the second straight month, all five index components rose... there was a broad consensus of improved sentiment across age, income, education, and geography." University of Michigan, Consumer Sentiment Index, Preliminary January Report, 1/19/24

"Pending home sales surged in December 2023, with month-over-month and year-over-year transaction gains...NAR forecasts a 13% increase in existing-home sales...in 2024," National Association of Realtors, Seasonally Adjusted Pending Sales Index, 1/26/24

"The U.S. economy notched another month of mild inflation... [Per the Fed's preferred inflation index) Using 3-month and 6-month annualized rates, core inflation was 1.5% and 1.9% respectively in December. 'It really is amazing that these 3- and 6-month rates are below 2% said Charles Evan, former President of the Chicago Fed." Wall Street Journal, 1/26/24, "Cooler Inflation Keeps Door Open for

Rate Cuts This Year"

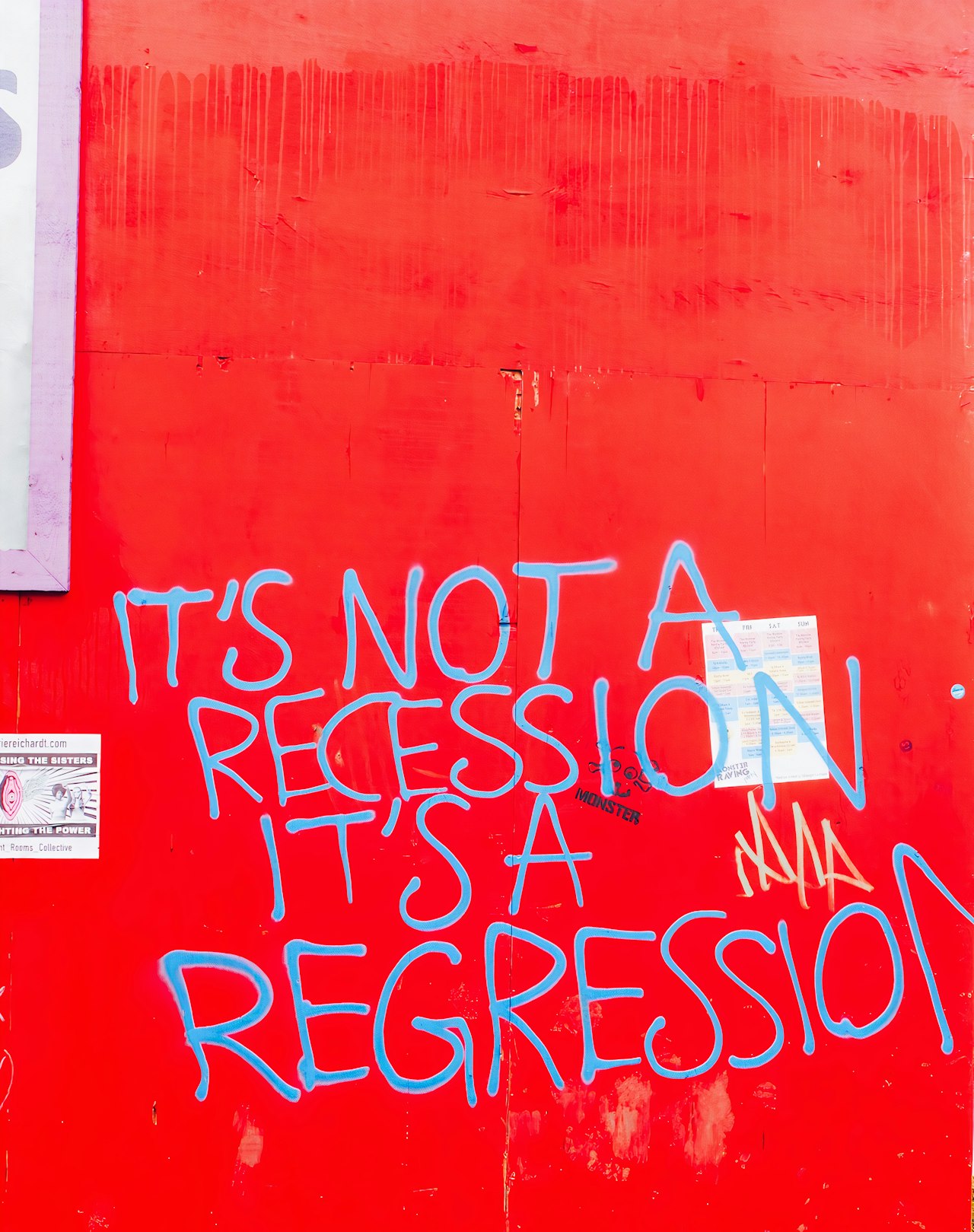

"The recession America was expecting never showed up. Many economists spent early 2023

predicting a painful downturn...Instead, the economy grew 3.1% last year, up from less than 1% in

2022, and faster than the average for the 5 years leading up to the pandemic. Inflation has

retreated substantially, Unemployment remains at historic lows, and consumers continue to

spend..." The New York Times, 1/26/24, "Economists Predicted a Recession. So Far They've Been Wrong."

After their steep plunge in November and December, interest rates leveled off in January, but remain at their lowest point since spring 2023.

A huge improvement in consumer confidence occurred in the last 2 months: Economic optimism is a critical driver of buyer demand.

Changes in financial market values impact household wealth, consumer confidence, and housing markets. Stock markets have soared since late October.

The economy in 2023 far outperformed the fears and low expectations with which the year began.

In recent years, investors have played an outsized role in the market as they've aggressively competed with ordinary homebuyers for listings.

National median house sales prices in 2023 came very close to the spring 2022 peak. Recent monthly prices are up on a year-over-year basis.

Perhaps due to their relative affordability in the markets in which they're common, the median condo/co-op sales price hit an all-time high in 2023.

Late 2023 market data wasn't significantly impacted by the improvements in economic conditions that began late last year. January data, due in late February, will be a much more important indicator, but the following charts illustrate trends and conditions in recent years, as well as the dramatic role of seasonality.

The number of new listings plunged since mid-2022, and December normally sees the lowest number of the year. Preliminary weekly data has early-2024 new listing activity up year-over-year. New listings typically climb rapidly through spring.

The inventory of active listings is mostly determined by the number of new listings, and how quickly buyers snap them up. Inventory rises rapidly as the new year's market wakes up, but will probably remain well below long-term norms.

While many homeowners have held back from listing their homes, the inventory of new-construction houses is approaching its 10-year high in 2022. Developers are eager to take advantage of unmet buyer demand.

Accepted-offer activity is a leading indicator for near-future sales. It usually hits its low point in December, then heats up quickly moving into spring.

Sales generally follow offer acceptance by 3-6 weeks, the typical period from contract negotiation to close of escrow. 2023 sales were far below historical norms.

The speed at which homes go into contract reflects the heat of demand. As with almost all market indicators, it ebbs and flows by season.

The percentage of all-cash sales remains very high by long-term standards. Undoubtedly, higher interest rates have been a major factor.

Multiple offers are an indication of buyers competing for a limited supply of well-priced listings. Competition is the main driver behind home-price increases.

The % of first-time homebuyers remains low, a classic example of repressed demand: They want to buy, but economic conditions have not cooperated.

Please let me know if I can ever be of assistance, in any way, to you or your family, friends and colleagues.